Video gaming is an enormous business. According to VentureBeat, profits from the industry are expected to reach $180.1 billion in 2021. Not only are the companies behind the popular titles capable of seeing huge profits, but the players, too. While the idea might have seemed far fetched a few years ago, at the top end of professional esports, there are players taking home significant paychecks, both from competitions and from streaming-derived revenue on popular platforms such as Amazon’s Twitch. In addition, advances in technology provide VR and mobile gaming room for significant growth in the new decade.

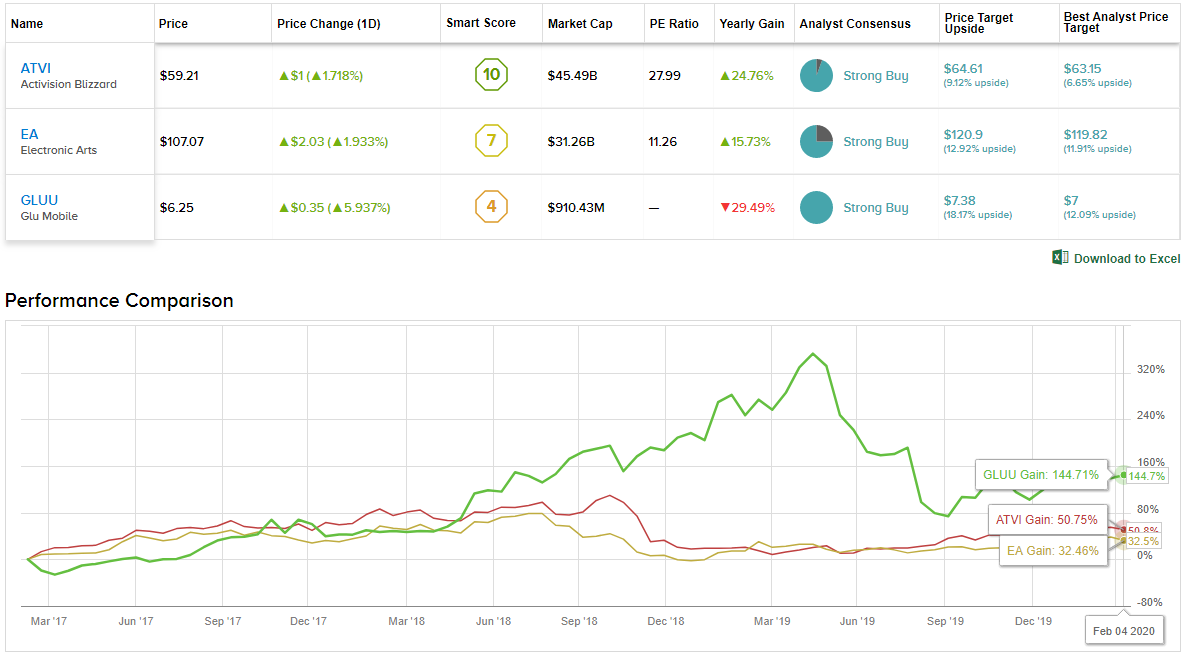

So, with our gaming consoles in hand, we decided to look further down the rabbit hole. Investment firms have been keeping a tab on players in the game, adding companies in the sector to their Millennial Exposure lists. Using TipRanks’ Stock Comparison tool, we decided to see how three gaming companies’ growth stories might play out in the year ahead. Let’s get this game started, then.

Activision Blizzard (ATVI)

Let’s start off with a gaming giant. American video game holding company Activision Blizzard is the most successful standalone interactive entertainment company in the world. Among its portfolio are some of the most successful franchises in the gaming industry. These include Call of Duty, Overwatch, Candy Crush Saga, World of Warcraft and Guitar Hero, amongst others. ATVI is one of only two gaming related companies to be listed on the S&P 500.

Following all-time highs achieved in the fall of 2018, ATVI stock came back down to Earth later that year as the rest of the gaming industry declined. The company recovered and performed well in 2019. Roughly in line with the broader market’s fortunes, the share price exited the year with a 28% gain. As major Activision Blizzard news hogged the headlines last month, the upward trajectory should continue in 2020.

So, what happened? In January, the company reported a major transition that involved signing a multi-year partnership with Google. ATVI will use Google Cloud for its hosting infrastructure, and, excluding China, YouTube will become the exclusive streaming outlet for broadcasts of ATVI’s esports competitions.

The new deal with YouTube will see ATVI leave Amazon’s Twitch after two years, and while the move appeared to be a curious one at first, once investigated, it makes more sense. Despite Twitch being the dominant player in the video game streaming universe, its growth is slowing down. With 1 billion users and an increase of over 45% in total hours spent watching gaming between the first and fourth quarter last year, YouTube becomes the logical choice. Google’s marketing nous, analytics and infrastructure technology are also reasons for the move.

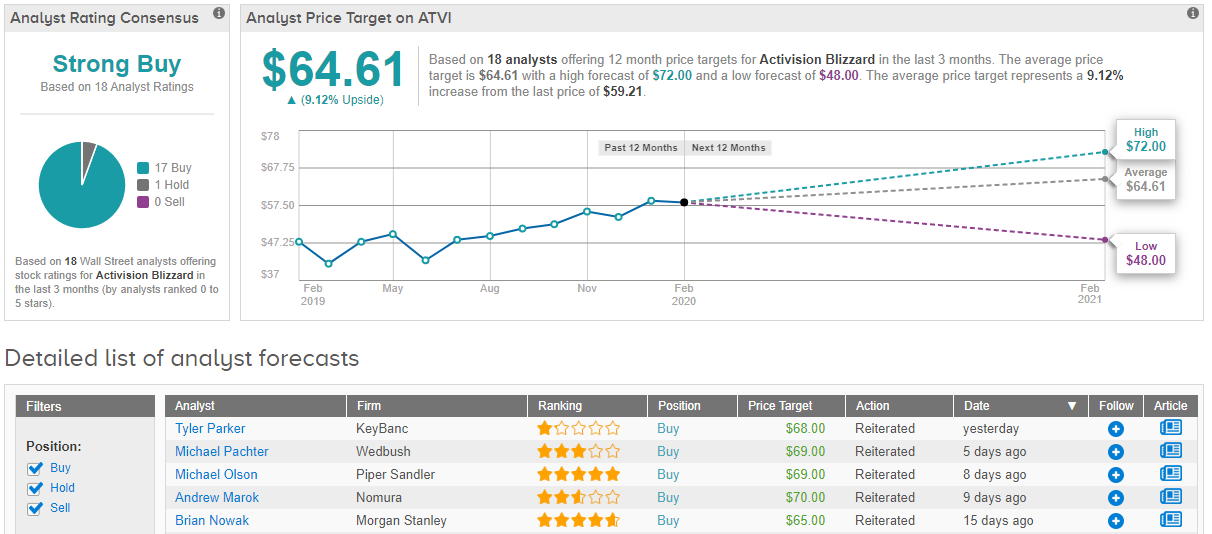

Nomura’s Andrew Marok believes ATVI is “set up well over the medium term.” The analyst said, “The announcement of YouTube as ATVI’s exclusive esports streaming partner registers as perhaps the most significant partnership in an increasingly competitive environment for gaming-focused streaming providers… We think the arrangement provides an interesting opportunity for ATVI; while YouTube is not primarily a gaming service, its broad-based nature and wide audience creates the opportunity for ATVI’s esports leagues to expand their reach into more casual fans that might not otherwise seek out esports content on gaming-specific sites.”

Marok, accordingly, reiterated a Buy rating on ATVI along with a price target of $70. The figure implies upward movement of a further 18%. (To watch Marok’s track record, click here)

The gaming king gets a thumbs up from the rest of the Street, too. 17 Buys and 1 Hold coalesce into a Strong Buy consensus rating. At the $64.61 average price target, the analysts see room for further growth of 9% in the year ahead. (See Activision Blizzard stock analysis on TipRanks)

Electronic Arts (EA)

If you were wondering what other gaming company is listed on the S&P 500, then wonder no more. Electronic Arts is the maker of the Battlefield series, EA Sports titles FIFA, Madden NFL and NBA Live, as well as Medal of Honor and Apex Legends, amongst a plethora of others. With a market cap of more than $31 billion, EA is the second largest gaming company in the US and Europe.

EA’s performance bested the market in 2019, with the company adding 36% to the share price along. Reporting FQ3 2020 earnings only last week, revenue came in at $1.59 billion, a 23% increase over the same period last year and beating the guidance of $1.51 billion. GAAP EPS of $1.18 easily beat last year’s $0.86 and guidance’s $0.92. Additionally, the all-important figure of net bookings jumped 23% to $1.98 billion.

Despite beating estimates across the board, the company’s stock fell by over 3% following the release. The reason? Soft guidance. Investors were disappointed with the Q4 bookings estimate of $1.152 billion, which was below the expected $1.2 billion. For the full year, the company forecasts bookings of $5.15 billion, lower than the consensus estimate’s $5.2 billion.

So, should the light guidance figures be a cause for concern? Not at all, argues Oppenheimer’s Andrew Uerkwitz. According to the 5-star analyst, EA’s plan to deliver long-term, stable growth along with games that appeal to a broader range of players with different preferences is a sound strategy.

EA’s Q3 beats on EPS and net bookings are reason enough for Uerkwitz to reiterate an Outperform rating on the gaming giant. Moreover, the positive print means the price target gets a bump, too, from $110 to $125. The implication? Possible upside of 17%. (To watch Uerkwitz’s track record, click here)

What does the rest of the Street make of EA’s prospects in 2020, then? A Strong Buy consensus rating breaks down into 15 Buys and 5 Holds. Should the average price target of $120.90 be met over the coming months, expect a 13% hike to the share price. (See Electronic Arts stock analysis on TipRanks)

Glu Mobile (GLUU)

Compared to the two other gaming giants on our list, Glu Mobile has a ways to go. The small-cap, though, is positioning itself in the fastest growing segment of the industry - mobile gaming.

A Research and Markets report expects the mobile gaming market (valued at $48.65 billion in 2017) to grow at a CAGR (compound annual growth rate) of 19.6% between 2018 to 2026. As the technology evolves and 5G networks become more widespread, Glu’s sole focus on developing games for smartphones and tablets positions it well for the years ahead.

Games currently driving the majority of bookings for the company include Design Home, Covet Fashion and Tap Sports Baseball. Its newly released title, Diner Dash Adventures, is performing well so far, while the company’s ever-expanding portfolio should see three new additions this year: Disney Sorcerer’s Arena, Deer Hunter Next and Originals, a choose-your-own adventure game.

KeyBanc's Tyler Parker recently initiated coverage of Glu Mobile with an Overweight rating and $8 price target. The figure conveys his belief Glu can add 28% to its share price over the coming year. (To watch Parker’s track record, click here)

Parker believes the game developer is among the companies most poised to benefit from the growing mobile gaming sector. The analyst sees improving profitability for Glu starting in the second half of 2020, with “significant margin expansion” to follow.

"We believe the mobile gaming market is attractive given the strong growth expected over the next few years, which should benefit scale mobile-first publishers,” he said.

The Street agrees. Of the 4 analysts tracked over the last three months, all press the Buy button on Glu. The company’s Strong Buy consensus rating is accompanied by a $7.38 average price target, and indicates 18% upside potential. (See GLUU price targets and analyst ratings on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

"exciting" - Google News

February 05, 2020 at 09:12PM

https://ift.tt/2Ur9OXD

Analysts: These 3 Video Game Stocks Represent Exciting Plays - Nasdaq

"exciting" - Google News

https://ift.tt/2GLT7hy

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Analysts: These 3 Video Game Stocks Represent Exciting Plays - Nasdaq"

Post a Comment